People assets claims are Arizona, California, Idaho, Louisiana, Las vegas, nevada, The new Mexico, Colorado, Washington, and you can Wisconsin. For many who and your mate stayed in a residential area possessions state, you ought to usually go after county laws to determine what is actually area possessions and you can what is actually separate earnings. Unlike filing a profit in writing, you happen to be in a position to document digitally having fun with Irs elizabeth-file. For more information, understand why Should i File Electronically, afterwards. Come across Table step one-1, Table 1-dos, and you can Table 1-step 3 for the certain number. For many who efforts your own business otherwise has almost every other thinking-a career money, such away from babysitting otherwise attempting to sell designs, see the following the books for more information.

Earliest, https://happy-gambler.com/xmas-joker/rtp/ declaration the loss in form 4684, Point B. You can also need range from the loss on the Function 4797 when you are or even required to document you to definitely function. To find your own deduction, create all the casualty or thieves losings out of this kind of assets incorporated to your Setting 4684, contours 32 and you can 38b, otherwise Form 4797, range 18a. For more information on casualty and thieves losses, find Pub. For individuals who and your partner try processing jointly and you may all of you had been qualified teachers, the utmost deduction are $600. But not, neither companion can be deduct more than $three hundred of their licensed expenditures.

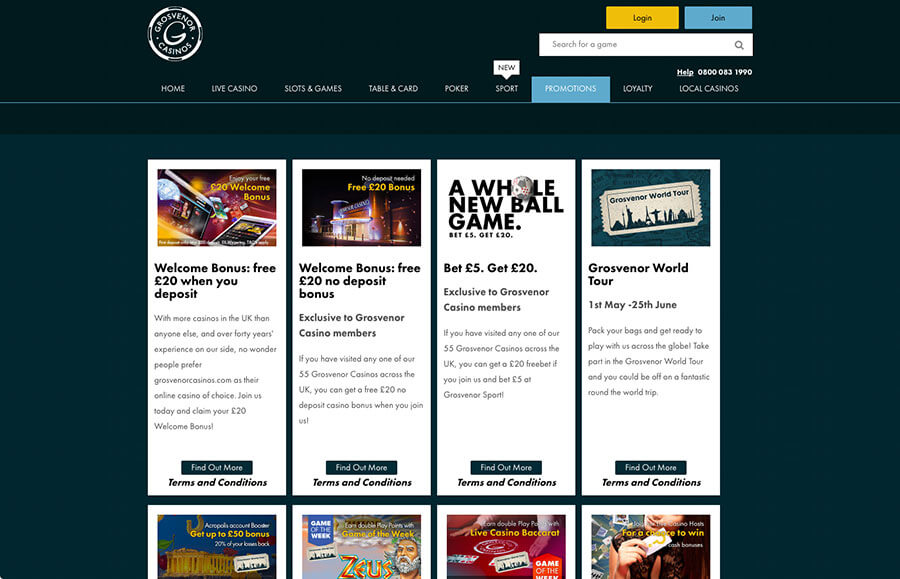

Finest Choices to help you $1 Deposit Gambling enterprises inside the Canada

As a whole, if the excessive efforts to possess a year commonly taken because of the day your own go back for the year is born (and extensions), you are susceptible to an excellent six% tax. You ought to pay the six% taxation every year to your too much quantity you to stay in the old-fashioned IRA at the conclusion of your taxation year. The newest taxation cannot be more six% of one’s joint property value all your IRAs as of the brand new stop of your own income tax year. If perhaps deductible efforts have been made to the traditional IRA (otherwise IRAs, for those who have several), you may have zero foundation in your IRA.

What is actually 7 rates within the money?

Include the federal tax withheld (since the found inside container 2 from Mode W-2) for the Form 1040 otherwise 1040-SR, line 25a. Taxpayer A great and you will Taxpayer B filed a joint return to possess 2024 demonstrating nonexempt money away from $forty eight,500 and tax from $5,359. Of your own $48,500 nonexempt earnings, $40,a hundred are Taxpayer A’s and the rest is Taxpayer B’s.

Its video game lobbies machine a variety of classes, their advertisements offer many different advantages, and their cashiers checklist of numerous Canada-tailored commission procedures. When taking benefit of a knowledgeable $step 1 deposit gambling establishment bonuses on the web, you have made a mixture of low-risk and you will high potential advantages. Some of the most preferred web sites worldwide let professionals join the a real income action that have well-known online game from the that it peak. While the game choice for the best $step one incentive gambling enterprises will be simply for slots, you’ve still got the opportunity to change short wagers on the really serious profits without the need to break your budget along the way.

Particular People Under Years 19 or Full-Go out People

I am aware your analysis I’m entry might possibly be used to incorporate me to the a lot more than-discussed services/otherwise characteristics and you may communications within the partnership therewith. Investors planned to get a lot more clinics to hold within the Sonus term, however, Dawson wished audiologists to run her companies. So traders signed up to exchange Dawson and sell, and therefore implied the brand new devaluation away from his inventory. Which have $200,100000 inside yearly severance for a couple of years, Dawson got time to strategize — and you may establish another team.

Home-Associated Issues Can also be’t Subtract

Since the talked about a lot more than, entertainment expenses are often nondeductible. Although not, you can even continue to subtract 50% of your own cost of business meals for many who (otherwise a member of staff) can be obtained plus the dinner or beverages aren’t sensed magnificent otherwise extravagant. You could’t subtract expenses (as well as initiation fees) to possess subscription in just about any bar organized for business, fulfillment, athletics, or other personal intentions. If you have you to costs complete with the expenses out of amusement or any other characteristics (including rooms otherwise transportation), you ought to spend some one to bills between the cost of enjoyment and you can the price of most other features. You’ll want a reasonable basis for rendering it allotment. Such, you should allocate your expenses in the event the a resorts comes with amusement within the its couch on a single expenses along with your area fees.

Such as, a wagering requirement of 20x on the a good $100 extra function you ought to choice at the very least $2000 just before withdrawing whatever you victory. The brand new players are asked which have a plus all the way to C$480, in addition to 80 100 percent free spins for $1 to your Super Currency Controls jackpot slot. Professionals must wager the first two put incentives two hundred minutes, while any promos features a betting dependence on 30x. Gamblizard try an affiliate marketer system you to definitely links participants which have best Canadian gambling establishment web sites to experience the real deal currency on the web.

It’s also advisable to discovered copies to help you document together with your county and you will local productivity. You could’t have any of your matter you credited for the projected taxation refunded for you if you do not file their income tax return to own the following year. After you build a projected income tax payment, alterations in your income, alterations, deductions, otherwise credit can make they important for you to refigure their projected taxation. Spend the money for outstanding equilibrium of your amended projected taxation because of the second payment deadline after the transform or even in installments by the you to definitely go out plus the repayment dates to the left fee symptoms.

To learn more, see the Instructions to own Form 1040 or Club. The brand new deduction to own condition and you will regional taxes is bound to help you $ten,100 ($5,100 if hitched filing partnered individually). County and local taxation is the taxation which you tend to be on the Schedule A good (Function 1040), traces 5a, 5b, and you will 5c. Were fees implemented by the an excellent You.S. territory together with your condition and you can regional taxes to your Plan An excellent (Function 1040), lines 5a, 5b, and you may 5c. However, do not were people U.S. territory taxes you paid which might be allocable in order to omitted money.

Sorry, the comment form is closed at this time.